|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

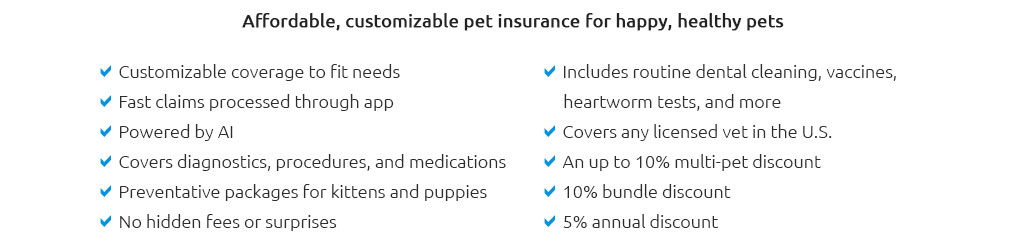

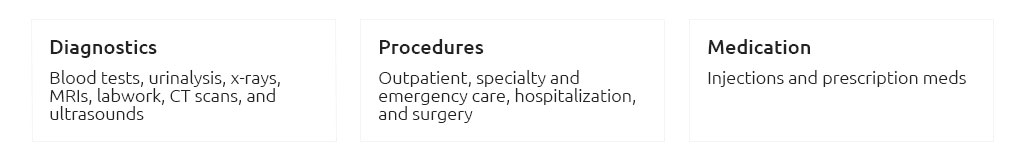

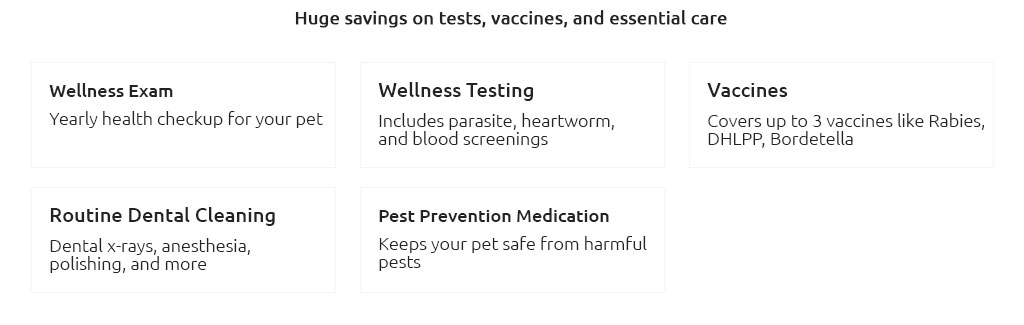

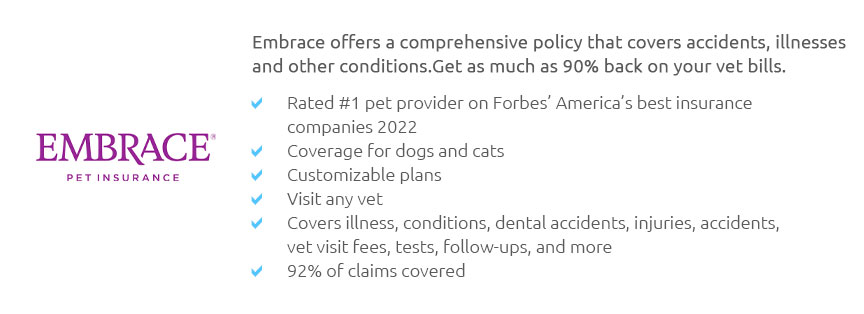

Pet Insurance Plans for Dogs Compared: A Comprehensive GuideChoosing the right pet insurance plan for your dog can be a daunting task. With numerous options available, it's important to compare plans to find the one that best suits your needs and budget. In this article, we will explore different types of pet insurance, their benefits, and some potential drawbacks. Types of Pet Insurance PlansAccident-Only PlansAccident-only plans cover injuries resulting from accidents such as fractures or ingesting foreign objects. These plans are usually more affordable and a good option if you are concerned about unexpected emergencies. However, they do not cover illnesses or routine care. Comprehensive PlansComprehensive plans offer coverage for both accidents and illnesses, providing a broader safety net for your pet's health. These plans often include coverage for hereditary and congenital conditions, making them a popular choice for pet owners seeking peace of mind. Wellness Add-OnsSome insurers offer wellness add-ons that cover routine care such as vaccinations, dental cleaning, and flea prevention. While these add-ons increase the premium, they can help manage regular veterinary expenses. Comparing Coverage Benefits

Pros and Cons of Pet InsuranceAdvantages

Disadvantages

If you are interested in options that start coverage immediately, consider exploring pet insurance without a waiting period to avoid delays in protection. Making an Informed DecisionWhen selecting a pet insurance plan, consider your dog's age, breed, and health history. Comparing multiple plans and reading customer reviews can also help ensure you make an informed choice. Additionally, some pet owners might consider pet life insurance plans for broader coverage. FAQs

https://www.petinsurance.com/dog-insurance/

Nationwide dog insurance offers customizable insurance plans that cover accidents, illnesses, and wellness starting as low as $13 a month*. https://www.usnews.com/insurance/pet-insurance

Summary: Spot sells policies for dogs and cats that cover accidents and illnesses and also has an accident-only option. It's available in all 50 states and has ... https://www.embracepetinsurance.com/compare

Read our helpful pet insurance comparison to discover different pet insurance options. We'll compare pet insurance companies side-by-side so you can decide ...

|